Capital Gain Tax Rate 2025 Real Estate

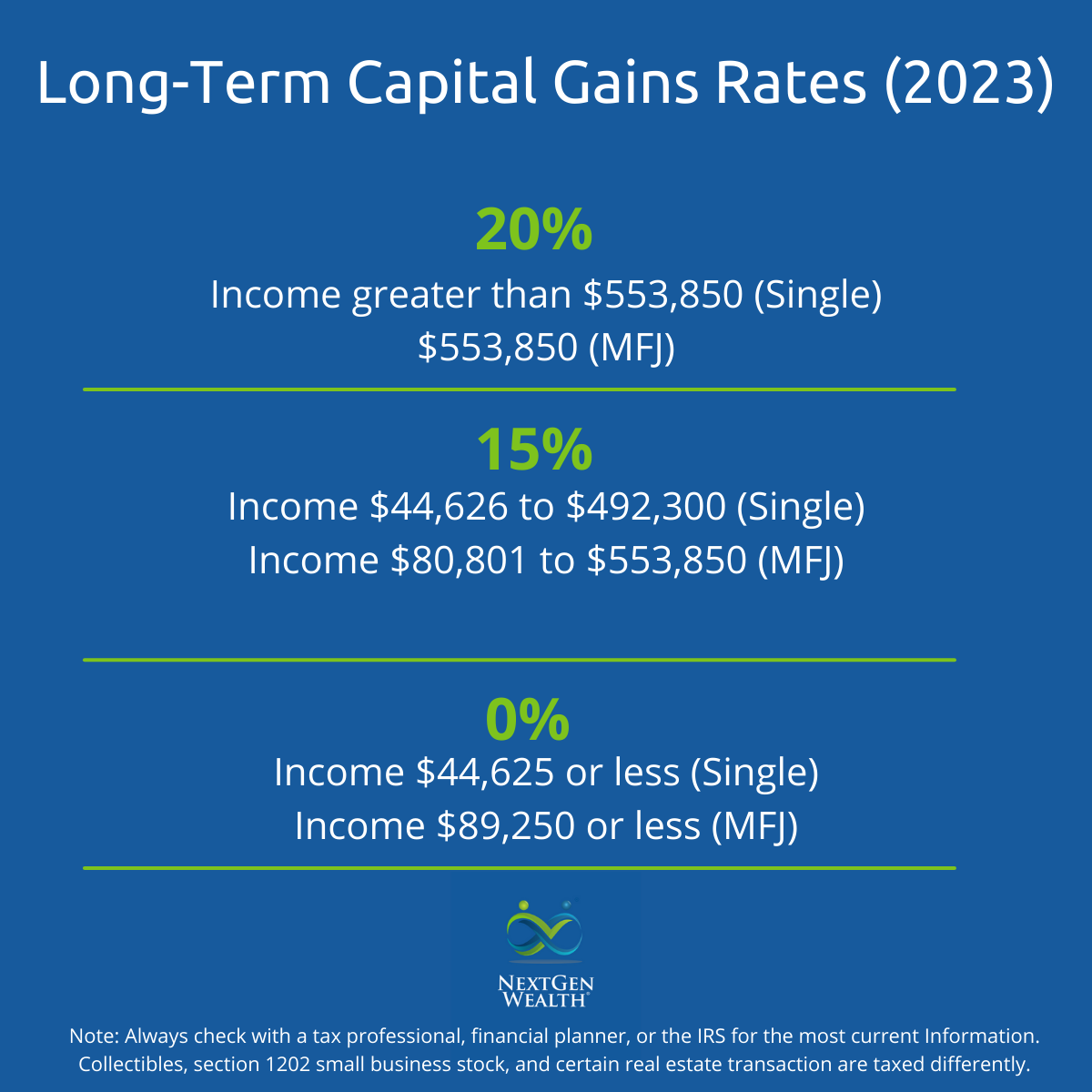

Capital Gain Tax Rate 2025 Real Estate. 0% for single filers with income up to $48,350 ($96,700 for married filing. Capital gains tax on rental property.

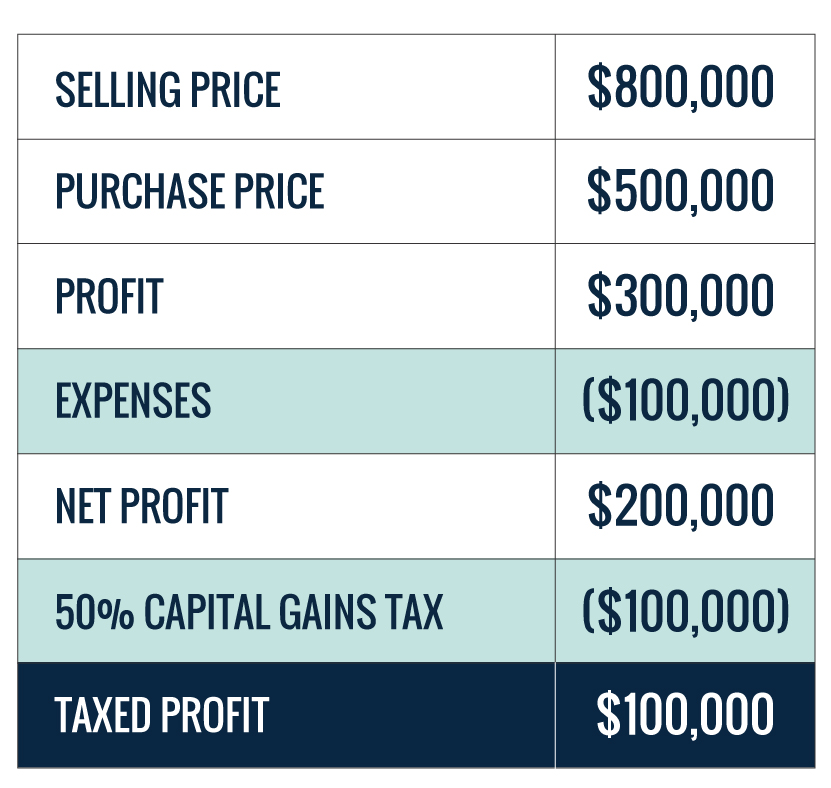

Capital gains taxes on real estate and property can be reduced or not assessed when you sell your home, up to certain tax limits, if you meet the requirements. Because the combined amount of £29,600 is less than £37,700 (the basic rate band for the 2025 to 2025 tax year), you pay capital gains tax at 10%.

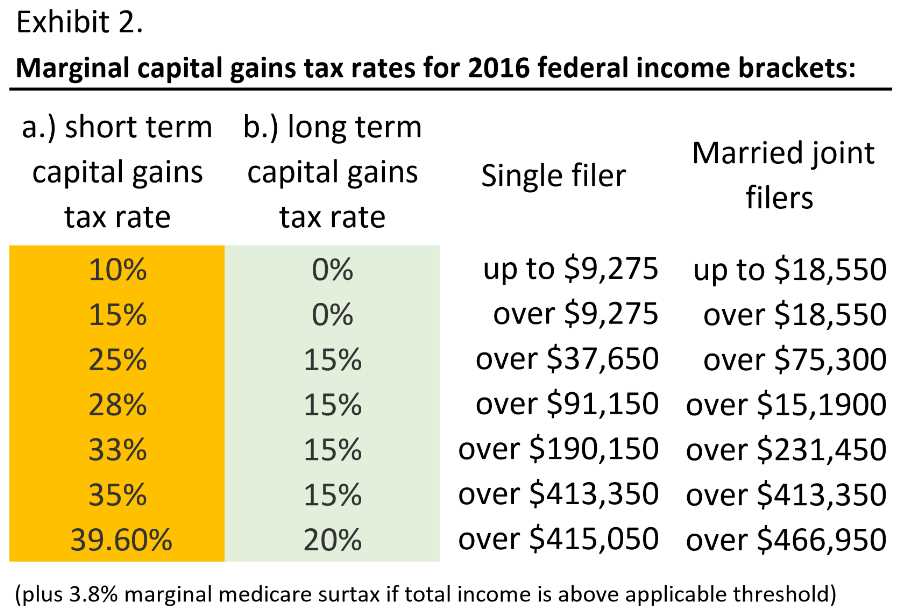

Capital Gains Tax Rate 2025 Real Estate Joey Beverlie, Capital gains tax rates are the same in 2025 as they were in 2025.

Capital Gains Tax Rate 2025 Real Estate Joey Beverlie, How much you pay depends on what you sold, how long you owned it before selling, your.

What Is Capital Gains Tax Rate For 2025 Uk Megan Knox, Btw consider the benefits of a self directed ira for your real estate investments.

.png?width=1920&height=1024&name=Short-Term_Capital_Gains_Tax_Rates_(2023).png)

2025 Long Term Capital Gains Tax Brackets Norry Malynda, Knowing the rules for capital gains tax on residential real estate and home sales is important, especially since your property has likely increased in value since you purchased it.

The Exciting World of Investment Property Taxes Toronto Real Estate, For taxation years that include.

Capital Gains Tax Brackets for Home Sellers What’s Your Rate?, Knowing the rules for capital gains tax on residential real estate and home sales is important, especially since your property has likely increased in value since you purchased it.

Irs Capital Gains Tax Rates 2025 Ashly Emelita, 0% for single filers with income up to $48,350 ($96,700 for married filing.

T230017 Distribution of Individual Tax on LongTerm Capital, Taxpayers bringing a reserve into income from a prior year capital gain will report the capital gain at the inclusion rate applicable for that tax year.